Despite Fed tough talk, there will be no interest rate normalization in this cycle, for the first time in United States history:

Fed Funds Rate: Turning Japanese

Adjusted for the increase in the U.S. population, the number of jobs has been declining for two pseudo-recoveries straight - Bush and Obama. That has never happened before in U.S. history.

Most of the jobs 'created' were low paying part-time jobs anyway:

Those were mighty expensive McJobs

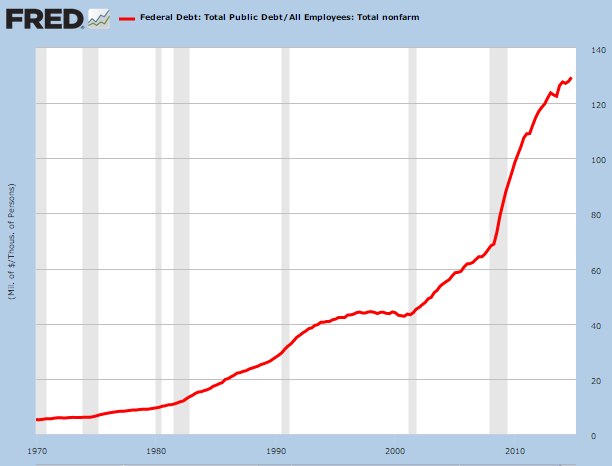

In terms of the amount of debt required to "create" each new job, the 'multiplier' has tripled since the year 2000:

BBG: March 13, 2015

Consumer sentiment declines unexpectedly

"The University of Michigan said Friday its preliminary index of consumer sentiment decreased to 91.2, a four-month low, from 95.4 in February. The reading was less than the most pessimistic forecast in a Bloomberg survey of economists whose median projection was 95.5."

Another cycle of bullshit is ending:

The Telegraph Jan. 1, 2015:

"America’s closed economy can handle a surging dollar and a fresh cycle of rising interest rates. Large parts of the world cannot. That in a nutshell is the story of 2015."