Copious dunces or reality. Choose carefully...

The first major Yuan devaluation was one year ago, meaning an entire year of extreme risk has been ignored.

The S&P is trading in the narrowest range in 40 years, while diverging from every other risk asset on the planet.

MW: July 29, 2016

The S&P 500 Hasn't Done This In 40 Years. And it's Bullish

It's bullish when stocks ignore risk. What else could it be?

Current divergences:

GDP

Profits

Deflation/Treasury yields

Oil/commodities

Financials

Retail

Energy

Healthcare

Growth/Tech

IPOs

Small Caps

High Yield/Junk Bonds

Carry trades

Rest of World

Transports:

S&P / Russell Ratio:

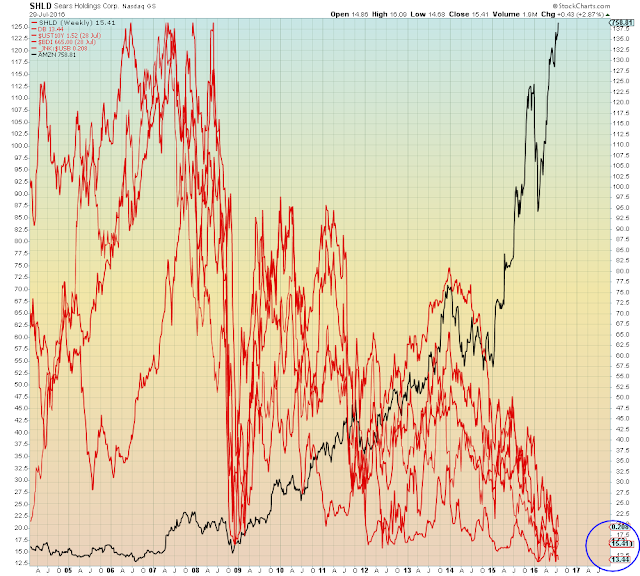

Amazon

Versus

Sears, Credit spreads, US 10 Year, German 10 Year, Deutsche Bank, Global trade (BDI):