Today's lesson is compliments of StockCharts Chart School:

"The Dow theory has been around for almost 100 years, yet even in today's volatile and technology-driven markets, the basic components of Dow theory still remain valid"

Remember that intraday, day-to-day and possibly even secondary movements can be prone to manipulation, but the primary trend is immune from manipulation. Hamilton and Dow sought a means to filter out the noise associated with daily fluctuations. They were not worried about a couple of points, or getting the exact top or bottom. Their main concern was catching the large moves...It is easy to get caught up in the madness of the moment and forget the primary trend.

Hamilton and Dow stressed that for a primary trend buy or sell signal to be valid, both the Industrial Average and the Rail Average must confirm each other. If one average records a new high or new low, then the other must soon follow for a Dow theory signal to be considered valid.

The Three Stages of Primary Bull Markets

Primary Bull Market - Stage 1 - Accumulation

Primary Bull Market - Stage 2 - Big Move

Primary Bull Market - Stage 3 - Excess

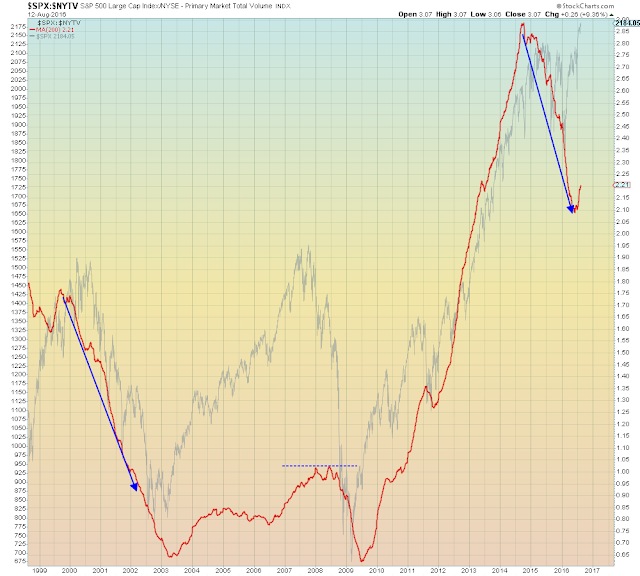

The S&P with the IPO Mutual Fund. The three stages of the bull market are labelled:

The Three Stages of Primary Bear Markets

Primary Bear Market - Stage 1 - Distribution

Distribution marks the beginning of a bear market. As the “smart money” begins to realize that business conditions are not quite as good as once thought, they start to sell stocks. The public is still involved in the market at this stage and become willing buyers.

Price over volume:

Price over volume with Transports:

Primary Bear Market - Stage 2 - Big Move

As with the primary bull market, stage two of a primary bear market provides the largest move. This is when the trend has been identified as down and business conditions begin to deteriorate. Earnings estimates are reduced, shortfalls occur, profit margins shrink and revenues fall. As business conditions worsen, the sell-off continues.

Earnings yield: