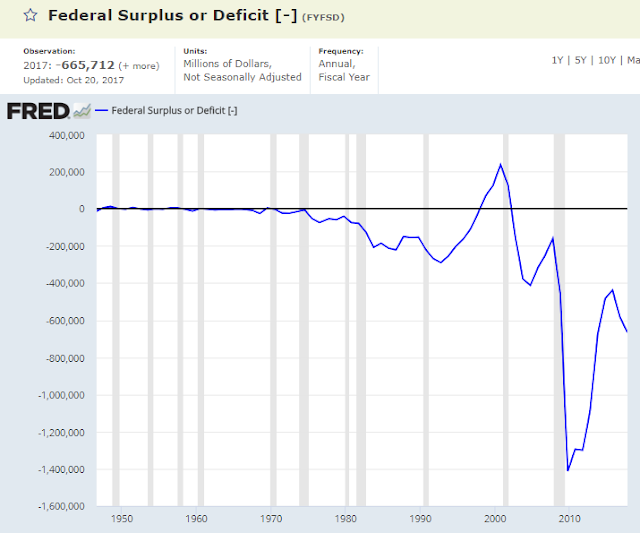

"Reagan proved that deficits don't matter" - Dick Cheney

"The U.S. Treasury Department reported last Friday that the federal budget deficit for the just-completed fiscal year had risen by $80 billion over fiscal 2016 to the ominous-sounding $666 billion, a number many people think is an omen for the coming of the devil or anti-Christ."

[Stop me any time]

"Unlike the four consecutive $1 trillion deficits recorded during the first years of the Obama administration, these trillion dollar annual deficits will be the result of enacted changes in federal spending and taxing rather than on a temporary economic downturn"

Speaking of artificially pulling forward growth using debt, deja vu of Y2K, today's momentum growth stocks are now massively leveraged to the economy. Their asinine valuations have financed over-investment in revenue growth models wholly dependent upon perpetual growth with no margin for recession. No one needs a 300 P/E retailer when overall retail sales turn down. And no one needs advertisements on Social Media when consumers are maxed out.

You know, like now:

Consumption sentiment decade high, personal savings rate decade low. Really, what could go wrong?

Consumption sentiment decade high, personal savings rate decade low. Really, what could go wrong?

Meanwhile, the liquidation of the entire rest of the retail sector can only go so far before it feeds back into the economy, making recession a self-fulfilling prophecy. And then, as I've said many times, these lines converge lower, as they're doing now...

Recession stocks are "leading" again: